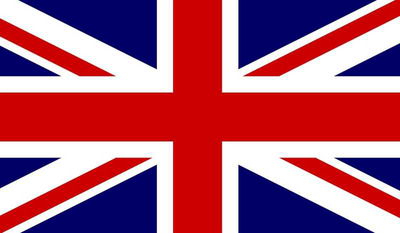

This quiz is about stock exchanges. Test your knowledge of global trade through the lens of national stock indices. From exports to equities, discover how countries flag their financial power. Can you match each stock exchange to its country? Good luck!

This quiz is about stock exchanges. Test your knowledge of global trade through the lens of national stock indices. From exports to equities, discover how countries flag their financial power. Can you match each stock exchange to its country? Good luck! Easier, 10 Qns, Kalibre,

Aug 13 25

Quick Question

Quick Question = Top 5% Rated Quiz,

= Top 5% Rated Quiz,

Top 10% Rated Quiz,

Top 10% Rated Quiz,

Top 20% Rated Quiz,

Top 20% Rated Quiz,